Lock in your lowest life insurance rate

A simple way to save on life insurance

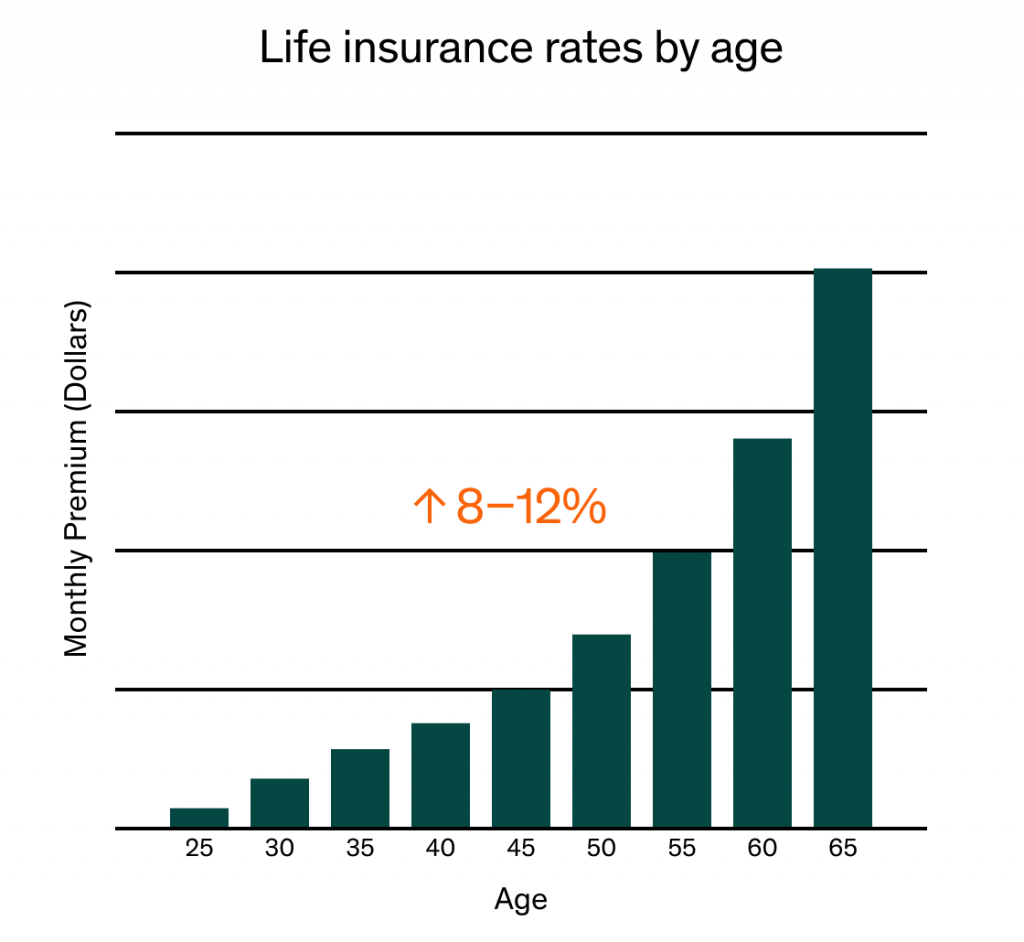

Purchasing life insurance early typically sets you up for your best rates. The average life insurance cost can increase by 8%, on average, for each year you delay. However, the moment you sign your policy, your rate is locked in and won’t change during the policy’s term.

For example, a 40-year-old non-smoking male in good health could get a new, 20-year term policy with $1 million coverage for $2,172 a year.* However, if he were to purchase the same policy at age 41, his cost would rise to $2,340 a year—and he’d spend $2,508 annually if he waited another year.

Average term life insurance rates by age

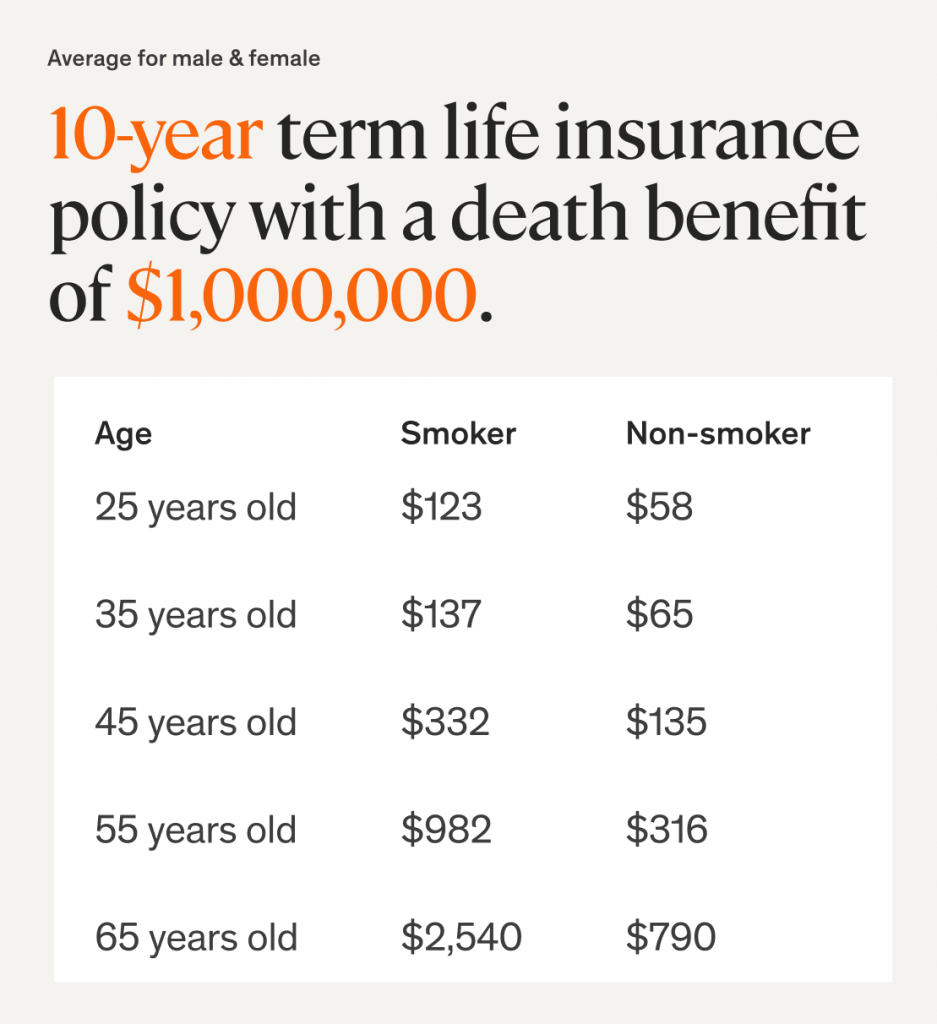

As you age, your average life insurance costs increase. Based on our policies, we developed a chart that shows the shift in premiums based on different age groups. The term life insurance quotes shown represent a 10-year term life insurance policy with a death benefit of $1 million for applicants in good health.

In this scenario, the monthly cost of life insurance for a 35-year-old non-smoker would be $65. A 45-year-old non-smoker would pay a $135 monthly premium for the same policy.* By purchasing this policy at age 35 instead of 45, you could save $840 per year over the life of your policy.

Common mistakes when

buying life insurance

Waiting until you have kids

Your health status is one of the most crucial factors when determining premiums. The healthier you are, the less you pay, so getting life insurance at a younger age can be advantageous. As you age, the risk of developing health issues (such as cancer or diabetes) can lead to higher premiums and sometimes make it difficult to get coverage. Securing life insurance earlier in life helps protect you—and those who depend on you—against any unexpected changes.

Relying on employer-sponsored coverage

Employer-provided life insurance is a nice benefit, but these policies rarely offer sufficient coverage. Employer-sponsored policies typically only provide coverage of one to two times your annual salary. However, financial experts recommend you carry coverage about ten times your salary. And any change to your employment status (such as retirement, layoff, or job change) likely means you’ll lose the policy. If a change occurs when you’re older—or after you’ve developed a health issue—it could be more expensive and difficult to secure new coverage. Having your own policy helps protect you and your loved ones against life’s unexpected changes.

Get your quote

How Hamilton life works?

Hamilton Life makes it easy to apply for a life insurance plan that helps

protect those you care about most.

Choose your coverage

Apply in minutes

Get coverage

A+ rated and backed by top insurance agencies

Hamilton life works with some of the world’s largest and most respected insurance companies, so you can feel confident and secure. Hamilton life puts our customers and their needs first, as is evident in our excellent user ratings.

See what verified customers say on Trustpilot

It was the easiest transaction ever

Great experience from start to finish

Fast approval & great life insurance rates!

Donald L.

Quick, Honest, Stress Free

Josh

We're here to help

We're featured in: